MUST - BEST PROJECT IN BLOCKCHAIN

We will present here a brief explanation of the MUST project, which is believed to be very potential. To be more clear and complete, you can listen to this article from our proposal.

The MUST system is the world's first block platform, which involves the spread of digital bonds in the framework of leasing vehicles, equipment, construction and specialized equipment.

The volume of the target market of the project MUST be 520 billion US dollars. According to low estimates, the project team plans to take 7.5% of the market for the next 5 years and show a turnover of 40 billion US dollars.

This will be achieved through:

A unique model of digital communication MUST Digital Bond and its circulation system on the exchange exchanges MUST.

Very profitable time to enter the market, institutional institutions with financial constraints in financing the IHR (AML, Basel II, Basel III).

Development and solutions of authors in the field of digitization and engineering and automotive engineering.

The system provides return on investment, built on the mechanism of tokenisasi kilometers and hours and asset monitoring.

The low, project team plans the next 5 years to take 7.5% of the market and show a turnover of 40 billion US dollars.

This will be achieved through:

A unique model of digital communication MUST Digital Bond and its circulatory system on the Free Exchange.

Very tempting time to enter the market, institutional institutions with financial constraints in financing IHR (AML, Basel II, Basel III).

Development and authoring solution in the field of digitization and engineering and automotive equipment.

The system provides return on investment, built on the mechanism of tokenisasi kilometers and hours and asset monitoring.

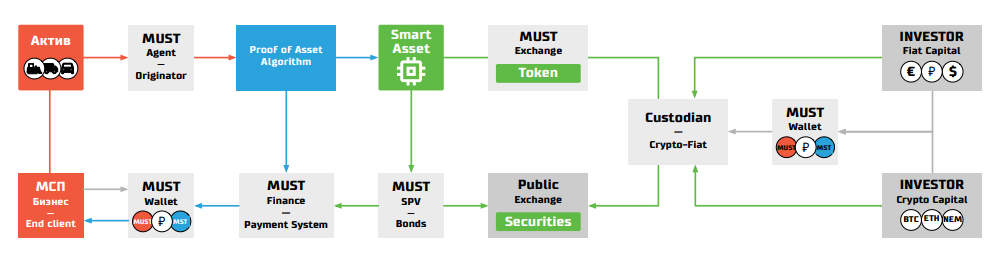

Ecosystems MUST

Below the MUST standards, our team has created a decentralized financing system for small and medium-sized enterprises around the world based on the end product of Tokenisasi and the financed market assets.

The MUST system allows small and medium-sized companies to obtain financing to acquire the assets needed to produce the final product on the market.

An enterprise can acquire assets, judgments that must be made in the final production unit of the market, and financing will also be provided in the final product.

This approach allows the company to implement the final product, which will be released in the future, and purchase the assets produced for the production of this product.

MUST Element system

In this system, there are many different roles, b with the main commercial role:

- End-customer - End-customers, SME entrepreneurs, interested in gaining access to financing. Owner of the token assets (Smart Asset).

- MUST Agent / Creator - MUST's service provider, acting as an operating agent in a transaction for the securitization of transactions / assets.

- Fiat Capital Investors - Private investors, banks or investment companies interested in investing in Smart Assets or Securities with a certain profitability. These investors include, among others, consumers of the final product.

- Crypto Capital Investor is a private investor, bank or investment company interested in investing capital of cryptography in Smart Asset with a certain profitability.

- Smart Asset is an asset that is a token, verified by the guarantor and connected to the monitoring system.

- The proof of the asset algorithm is a unique algorithm of tokenization and asset securitization. Includes: Smart Tokenizer Assetizer and Smart Asset Escrow.

- MUST SPV - a specialized company, issuer of securities issued on the basis of Smart Branded Assets.

- MUST Wallet. Service for file exchange and crypt currency for identification of the token, MST and user KYC in the system.

- Crypto-Fiat Custodian is a service that includes a number of solutions aimed at managing the "cold" storage of its cryptically-loaded assets, performing classical storage functions. Give the opportunity to use cryptoactive assets for accounting.

- MUST Exchange - cryptoactive exchange, the main purpose is to organize transactions for the sale of tokens. A familiar exchange interface will quickly and easily start using new financial instruments.

- General exchange - A classic exchange that will trade in securities issued under Smart Assets.

The products MUST

- MUST Renta - rental services for SMEs.

- MUST Lending is a credit service provided by assets on the MICEX.

- MUST Escrow is a service for financing trade operations through the assets of tokenisasi, which will be financed under the transaction.

- MUST Bond Digital (MDB) - Digital bonds issued in the process of securitization based on tokens and cash flows on it.

token holder must have access to all ecosystem services and offers from a cost-based economy. The account SHOULD provide the holder with the right to withdraw when paying commission on the MUST Exchange in accordance with the following schedule:

HB-2019 Q4 -50%

2020 Q1-2020 Q4 -75%

2021 Q1 -2021 Q4 -80%

2022 Q1 -2022 Q4- 90%

All The tokens received by the system MUST be because the commission payments will be burned. After listing on the tag, the tokens MUST be redeemed for fixed cryptoactive or other currencies.

Number of issued tokens 500 000 000 Additional emissions are not provided. And tokens must be issued in accordance with the ERC223 standard in the Ethereum network.

Current sales

Private PreSale / 25.02 - 30.06.2018 /

Bonus + 20%

Public PreSale / 01.07 - 31.07.2018 /

Bonus + 10%

Sale of the total token / 01.08 - 30.08.2018 /

Bonus 0%

Token

1 MUST = 0.10 USD

Soft cover = $ 6,700,000

Hard Cap = 35,000,000 USD

Sales Current - 350,000,000

Team - 50,000,000 (before the 3rd quarter of 2019)

Marketing and adviser - 25,000,000

MUST Foundation - 75,000,000 (up to 3 sq. M.). 2020)

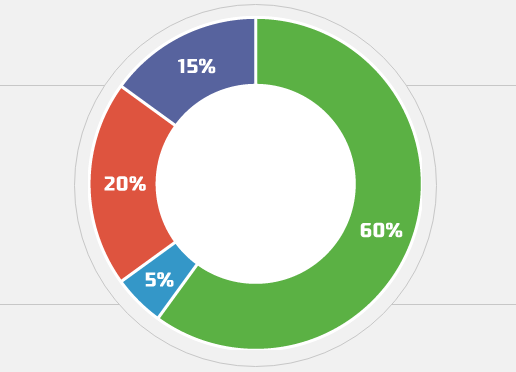

Distribution of

R & D investments - 15%

Law - 20%

Marketing - 60%

Operating expenses - 5%

Q2 2015

from

Start working on a standard description of the technology;

Prototype Q3 2016

The first version of the Inspect application;

Q1 2017

Auction auction

and testing of business models;

Q3 2017

rebranding

The first version of the market MUST.Ru;

Q3 2017

presentation

The official release of MUST.Ru on COMTRANS 2017;

Q3 2017

Stock Exchange MUST

Start MUST check the stock market check;

Q1 2018

MUST RENTA RU

MUST EN Audit EN

MUST HAVE

MUST Check

MUST be standard 1

Q2 2018

MUST control EN

MUST INDEX

MUST be an Agent RU

Must be an account expert

MUST auction RU

Q3 2018

MUST BE Digital Bond

Must Change

Q4 2018

MUST Loan RU

Q1 2019

MUST THE

EU

MUST THE EU MUST THE EUROPEAN UNION MUST BE THE EU EXPERT

MUST be an

EU auction

Q2 2019

MUST HAVE A EUROPEAN UNION

SHOULD HAVE A EUROPEAN UNION being an EU agent

MUST control EU

Q3 2019

MUST lend to the EU

Q4 2019

MUST Audit AF

MUST check AF

MUST AF AFTER MUST AF

Experts

AF MOST AF Auction

Q1 2020

MUST use AF AF

MUST AF Agent

MUST monitor AF

Q2 2020

MUST AF AF

Q3 2020

MUST LAT Audit

MUST verify LAT

MUST BE PRICE

MUST LAT LAT Experts

MUST be auction

Q4 2020

MUST HAVE A LAT

MUST be a LAT agent

MUST control LAT

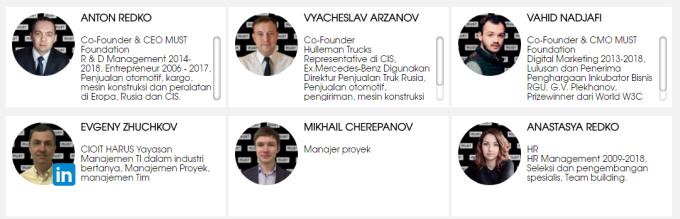

TIM

In essence, it can be concluded that Must.io is the main standard of the underlying transaction for the economic value of micro, small and medium-sized enterprises. In the financing system, there is a decentralized economic value of micro, small and medium enterprises through tokenization of kilometers and hours.

FOR MORE INFORMATION

Website: https://must.io/

Ann Thread: https://bitcointalk.org/index.php?topic=4509154

Technical documentation: https://must.io/whitepaper. PDF

Facebook: https://www.facebook.com/mustfinex

Twitter: https://twitter.com/mustfin

Telegram: https://t.me/must_en

Youtube:https://www.youtube.com/channel/ UCE_f7jxOCOoGL3a0l73AUxQ

Instagram: https://instagram.com/mustfinance

Author by: familyforever

Comments

Post a Comment